TVSMOTORS : SMOOTH RIDE AHEAD WITH MOMNETUM ... !!!

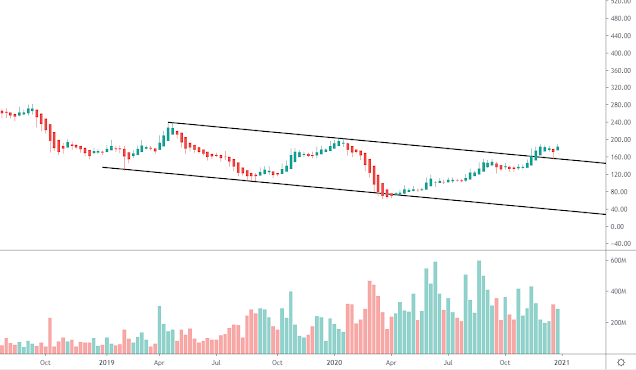

This stock has been a laggard for the last couple of years and has remained under pressure from 2018-2020 (April). The stock registered bottom in April 2020 around 250 mark and has seen steady upmove thereafter till 500 levels. However, post that the stock has turned sideways and remained lackluster comparing with its peers.

Technically speaking the stock chart is promising and signals a smooth side ahead with supportive momentum. On the weekly chart, the stock has registered a breakout from a probable V-shaped pattern which is considered to be a bullish trend reversal pattern in nature and signals a trend signal going forward. Also, considering the Price-Volume action is quite bullish and injects further confidence in the trend. The volumes have increased with rising prices which is a bullish sign and complements the bullish view on price.

The next chart attached is the Ratio chart of TVSMOTOR/CNXAUTO which displays an important pointer to note. The Ratio has been consolidated in the sideways range for the last many months and currently, the ratio has dropped to the Support zone (Highlighted in Green) which compliments a bullish view on price. Also, the momnetum indicator has dropped to a lower trendline of the channel which adds further confirmation that the Ratio likely to hold its previous support zone and to inch higher in going future.

Furthermore, The Auto sector shall witness further strength going forward and likely to outperform the benchmark index in the coming months. The next chart attached below is the Ratio of CNXAUTO/NIFTY which is throwing the bullish signal and indicating the Auto Sector would outperform the Nifty.

Thus following the above studies and other Technical tools I believe the stock has further legs to scale higher and in with the support of the Auto Index doing good, shall provide a further push in price momentum to inch higher to towards 580-630-675 levels in short to medium term. In case of any corrective decline, the demand force is expected to emerge around 500-485 levels. While the above view shall void if the price closes beneath 474 levels.

THANK YOU FOR READING !!! IF YOU LIKE THE POST DO SHARE & COMMENT...

FOLLOW THE BLOG FOR REGULAR UPDATES.

GOODLUCK!