CESC : Good Days are back !!?!

This stock has been on my radar for the past couple of months, if you are following me on Twitter, you would have noticed, I had shared the chart on CESC at regular intervals. However, looking at the last few week's price action and overall chart formation I believe the stock is ready for the serious rally from here and which encouraged me to write a Blog on the same.

The first chart shown below is the Monthly chart of CESC, from the chart it is evident that stock has been trading in an Ascending Channel for last more than 11 years. The bottom formed last year was placed near the lower end of the channel. Also, recently stock registered breakout from falling resistance trendline which is a bullish signal and hints price to scale higher towards the higher end of the upsloping channel trendline.

Another interesting setup was observed in the DMI indicator. In the last 2 instances, whenever DI+ line has crossover DI- line and post that the ADX line surpasses 20 levels or is above 20 readings, the price has witnessed strong had sharp upside momentum. A similar setup has been witnessed recently and if the setup unfolds like earlier, the price likely to see a powerful and strong rally in the coming weeks and months. (Notice the last 2 weeks' price action, swift and powerful).

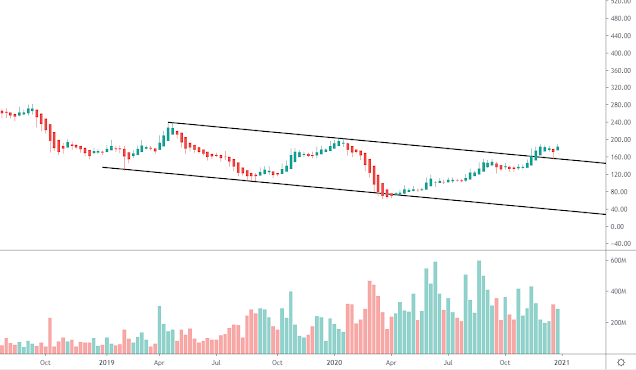

The second chart attached below is the weekly chart of CESC which highlights the stock saw a sharp selloff in early 2020 and post that formed a bottom in late march 2020 and then delivered a strong rally for 4 weeks out of 5 weeks. Thereafter stock turned sideways, lackluster, and continued to trade in a range for more than 11 months, and in early June price registered a decisive breakout from prolonged consolidation accompanied by a surge in volumes.

The breakout has occurred with above average volumes which provide further confirmation and increases the reliability of the breakout. Moreover, looking at the Price-Volume behavior it has been observed, the volumes bars are bigger on the advancing day while small on the down days which is a bullish sign and compliments bullish view on price.

The next chart displayed below is the Ratio chart of CESC and Nifty 50, these charts help to identify the strength in the stock compared to the Index. The Ratio chart has multiple positive triggers which hints that the stock is likely to outperform the benchmark index in the coming weeks and months.

The ratio has reversed strongly hitting the multi-month demand zone which also coincides with the lower end of the Downsloping channel trendline which is a bullish signal. Aswell, RSI has surpassed the falling trendline and MACD as given bullish crossover after a good of amount of time which compliments bullish on price and indicates the stock has a high probability to outperform the Nifty 50.

Thus, from the above Technical Studies, I believe good days are back and stock to scale higher in the coming weeks to come. On the higher side stock has the potential to move higher towards 860-920-1000 levels in short to medium term time frames. While on the downside strong support is placed near 770-740.

THANK YOU FOR READING !!! DO SHARE YOUR FEEDBACK. COMMENT YOUR VIEWS BELOW, SHARE FOR WIDER REACH...

FOLLOW THE BLOG FOR REGULAR UPDATES.

GOOD LUCK!

STAY SAFE - STAY HEALTHY